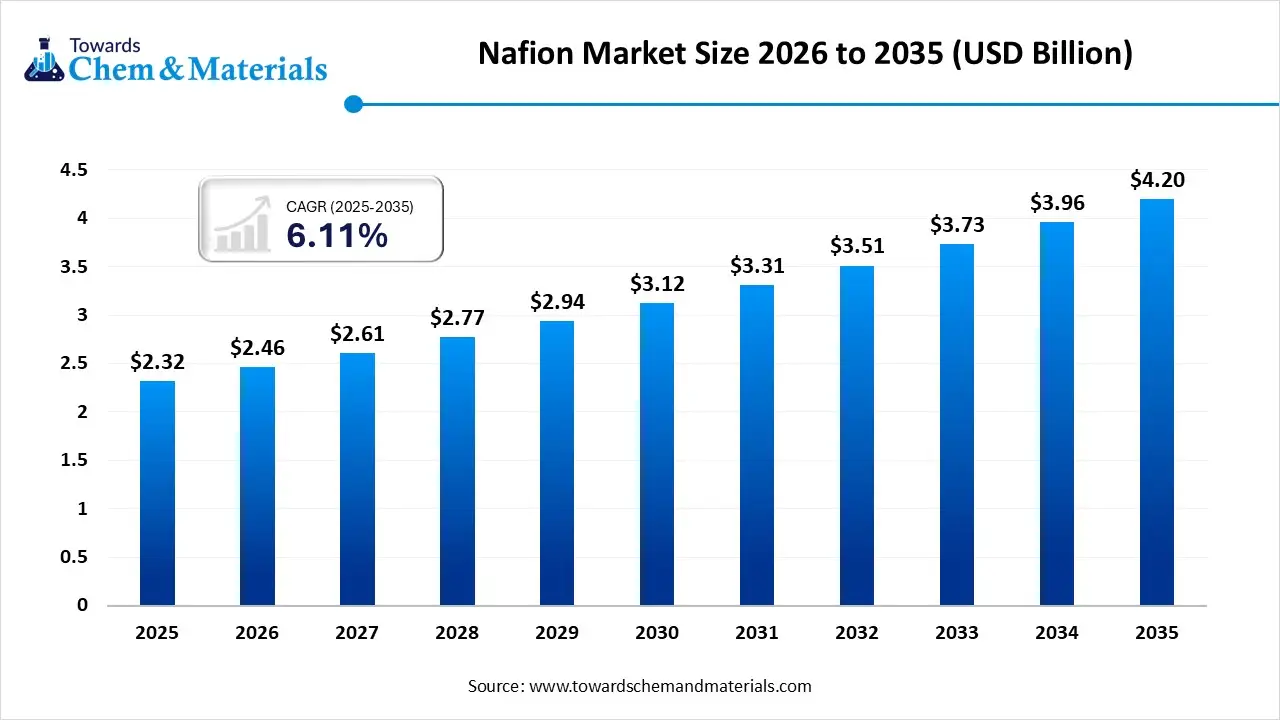

Nafion Market Size to Worth USD 4.20 Billion by 2035 - Exclusive Report by Towards Chemical and Materials

According to Towards Chemical and Materials, the nafion market size is worth USD 2.46 billion in 2026 and is growing at a CAGR of 6.11% to reach USD 4.20 billion by 2035.

Ottawa, Feb. 16, 2026 (GLOBE NEWSWIRE) -- The global nafion market size was valued at USD 2.32 billion in 2025 and is expected to be worth around USD 4.20 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.11% over the forecast period from 2026 to 2035. The emergence of hydrogen technology has accelerated the industry's growth in recent years. A study published by Towards Chemical and Materials a sister firm of Precedence Research.

Download a Sample Report Here@ https://www.towardschemandmaterials.com/download-sample/5633

Nafion Market Report Highlights

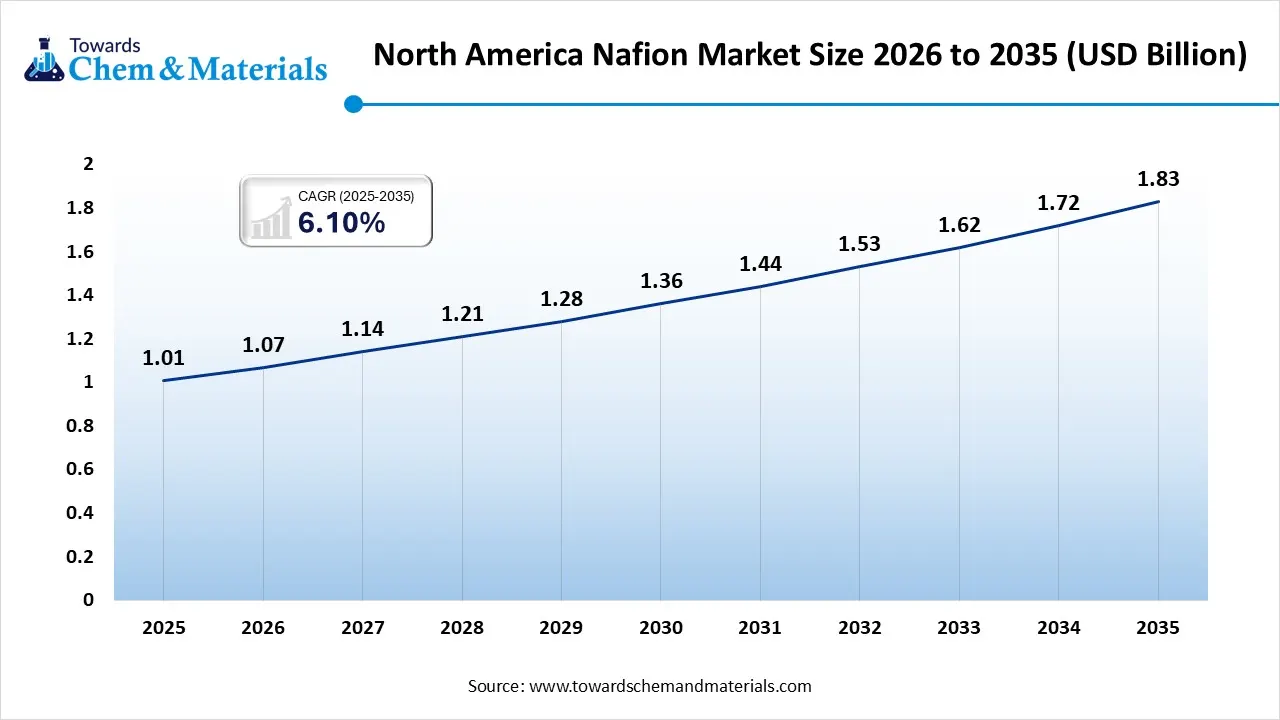

- The North America dominated the nafion market with the largest revenue share in 2025.

- By region, Asia Pacific is growing at the fastest CAGR in the market during the forecast period due to the growing demand from various industries.

- By application, the fuel cell segment dominated the market with the largest share in 2025 due to the increasing demand for cleaner energy sources.

- By application, the chlor-alkali process segment is expected to grow at the fastest CAGR in the market during the forecast period due to the growing wastewater generation.

- By product type, the membrane segment led the market in 2025 due to the growing demand from electrochemical applications.

- By end use, the energy segment dominated the market with the largest share in 2025 due to the growing demand for renewable energy sources.

- By form factor, the sheet segment led the nafion market in 2025 due to the growing demand from the chlor-alkali industry.

Nafion: The Backbone of Proton Technology

The special synthetic polymer can conduct protons well. Also, having both hydrophobic parts, the Nafion is expected to support the long-term expansion of manufacturing operations during the forecast period. Also, the Nafion has been seen working well in higher temperatures and harsh chemical conditions, as per the recent observation.

Private Industry Investments for Nafion Industry

- Chemours $200 Million Expansion: Chemours invested $200 million to expand its Villers-Saint-Paul facility in France to increase the manufacturing capacity of Nafion ion exchange materials for the hydrogen economy.

- Accelera by Cummins 100MW Electrolyzer Project: Accelera secured a contract in early 2025 to supply a 100-megawatt PEM electrolyzer system in Germany, representing a major commercial scale-up for Nafion-dependent technology.

- Plug Power and Olin Corp Joint Venture: These companies launched commercial operations at a green hydrogen plant in Louisiana in 2025, utilizing large-scale PEM stacks that rely on high-performance membranes.

- Merck KGaA Semiconductor and Chemical Scale-up: Merck invested roughly $3.27 billion through 2025 into its Electronics business to enhance high-tech chemical production, including materials relevant to ion-conductive applications.

-

Solvay Mining and Reagent Capacity Boost: Solvay completed a 20% capacity increase for its ACORGA solvent extraction lines, supporting the broader industrial chemical infrastructure that utilizes Nafion-based technologies.

Request Research Report Built Around Your Goals: sales@towardschemandmaterials.com

What are the Major Trends in the Nafion Market?

- Shift Towards the Use of Hydrogen Fuel Cells: The shift towards the use of hydrogen fuel cells has generated significant opportunities for industry participants in recent years. Also, the Nafion membrane seen in helping fuel cells work efficiently.

- Water Electrolysis Systems: The increasing usage of Nafion in water electrolysis systems has enhanced market participation for producers in the past few years. As the Nafion membrane has observed in improving efficiency while separating gases

-

Smaller Electronics and Sensors: The emergence of smaller electronics and sensors is expected to open profitable avenues for manufacturers during the forecast period. Moreover, the nafion has using in biosensors, gas sensors, and micro fuel cells.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5633

For more information, visit the Towards Chemical and Materials website or email the team at sales@towardschemandmaterials.com| +1 804 441 9344

Nafion Market Dynamics

Driver

Smaller Devices, Greater Performance

The rapid growth of clean energy and the hydrogen economy has supported the stronger cash flows for manufacturing enterprises in the current period. Moreover, the countries want to reduce carbon emissions. Hydrogen fuel cells and electrolyzers need high-performance membranes. Nafion is already trusted in these systems. Government funding and climate policies support hydrogen projects. Industries prefer reliable materials to avoid failure.

Restraint

High Nafion Costs Limit Market Growth

The high cost of manufacturing Nafion is expected to create growth barriers for the market in the coming years. Also, Nafion is expensive to produce because it uses complex chemical processes and fluorinated materials. This increases the overall cost of fuel cells and electrolyzers. Small companies and cost-sensitive markets find it difficult to adopt Nafion. Cheaper alternative membranes are being developed.

Market Opportunity

What is the Most Significant Opportunity for the Nafion Market?

The expansion of green hydrogen projects is anticipated to create lucrative opportunities for manufacturers during the projected period. Also, many countries are building hydrogen plants using renewable energy. These projects need durable and efficient membranes. Nafion already has proven performance in electrolysis and fuel cells. As hydrogen moves from pilot projects to commercial scale, membrane demand will grow fast.

Advanced Nafion Membranes Boost Performance

The shift towards the development of thinner and modified Nafion membranes is likely to enable high-return ventures for manufacturers in the coming years. Also, companies are reducing membrane thickness to improve efficiency and lower material use. Modified Nafion improves conductivity and reduces water loss. These changes help fuel cells operate at higher temperatures and lower humidity. This improves performance and system design flexibility.

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5633

Nafion Market Segmentation Insights

Application Insights

Why did the Fuel Cell Segment Hold the Biggest Share in the Nafion Market?

The fuel cell segment dominates the market, owing to Nafion, which is the most trusted membrane for proton exchange fuel cells. It offers high proton conductivity, chemical stability, and long life. Fuel cells need reliable membranes to operate continuously. Nafion performs well under heat, humidity, and pressure changes.

The chlor-alkali process segment is experiencing the fastest growth in the market during the projected period, due to the industry's need for cleaner and more energy-efficient chemical production. Nafion membranes improve efficiency in chlorine and caustic soda manufacturing. Environmental rules are becoming stricter, forcing plants to upgrade older technologies.

Product Type Insights

How did the Membrane Segment dominate the Nafion market?

The membrane segment dominates because membranes are the core working component in most applications. Fuel cells, electrolyzers, and chemical processing systems directly require solid Nafion membranes. Membranes are easy to integrate into systems and offer stable performance. Manufacturers prefer ready-to-use membrane sheets over raw forms.

The dispersion segment is anticipated to grow fastest during the projected period, owing to manufacturers wanting flexibility in design nowdays. Also, the Nafion dispersions allow coating, spraying, and advanced fabrication methods. They are used in next-generation fuel cells, sensors, and thin films. Dispersion helps reduce material waste and cost. New technologies require customized membrane layers, which dispersions enable.

End Use Insights

Why did the Energy Segment Hold the Biggest Share in the Nafion market?

The energy segment dominates the market, owing to energy systems adopting Nafion early. Fuel cells, electrolyzers, and hydrogen systems rely heavily on Nafion membranes. Energy companies invested in clean power and backup systems. Nafior supports stable energy conversion and storage. Governments funded renewable energy projects using Nafion-based technologies.

The automotive segment is experiencing the fastest growth in the market during the projected period, due to rapid growth in fuel cell vehicles. Automakers are investing in hydrogen mobility to reduce emissions. Nafion membranes are essential for vehicle fuel cell stacks. Governments support zero- emission transport with subsidies. Heavy-duty trucks and buses are shifting toward hydrogen.

Form Factor Insights

How Did the Sheet Segment Dominate the Nafion Market?

The sheet segment dominates because it is easy to handle and install. Also, the sheets are commonly used in fuel cell stacks and industrial equipment. Manufacturers prefer standard sheet sizes for faster assembly. Sheets offer uniform thickness and consistent performance. Quality control is easier in sheet form. Early Nafion products were mainly sold as sheets, creating market familiarity.

The film segment is projected to grow fastest during the projected period, owing to modern applications for thinner materials. Nafion films reduce weight and material usage. Compact fuel cells and portable devices prefer thin films. Films improve efficiency and power density. Advanced coating and roll-to-roll manufacturing support film production. Automotive and electronics industries demand lightweight components.

Regional Insights

The North America nafion market size was valued at USD 1.01 billion in 2025 and is expected to be worth around USD 1.83 billion by 2035, exhibiting at a compound annual growth rate (CAGR) of 6.10% over the forecast period from 2026 to 2035. North America dominated the nafion market in 2025.

The North America region leads the global Nafion market due to its adoption of fuel cell and hydrogen technologies earlier than other regions. Moreover, the United States invested heavily in clean energy research, defense energy systems, and space programs, where Nafion membranes are widely used. Strong universities, laboratories, and private companies helped improve Nafion's performance and scale production.

U.S. Nafion Market Trends

The U.S. market is expanding as demand grows for high-performance ion-exchange membranes in fuel cells, electrolyzers, and other electrochemical applications driven by clean energy and hydrogen economy goals. Increasing investments in renewable energy infrastructure and decarbonization initiatives are boosting adoption of Nafion membranes in proton exchange membrane (PEM) fuel cell systems for transportation and stationary power.

Why is the Nafion Market Growing Rapidly in the Asia Pacific?

The Asia Pacific region is the fastest-growing region, akin to fast industrial growth and large clean energy investments. The regional countries, such as China, Japan, and South Korea, are building massive hydrogen plants and fuel cell factories. Asia Pacific focuses on cost reduction and large-scale manufacturing, which supports Nafion demand. Growing electric mobility, renewable power, and green hydrogen exports increase membrane usage.

China Nafion Market Trends

China's market is growing as demand rises for high-performance ion-exchange membranes in fuel cells, electrolyzers, and other electrochemical systems supporting the country's clean energy and hydrogen development strategies. Expansion of hydrogen infrastructure, including production, storage, and fuel cell vehicle adoption, is driving increased use of Nafion membranes in proton exchange membrane (PEM) fuel cell applications across automotive and stationary power sectors.

Top Companies in the Nafion Market & Their Offerings:

- Nafion™ (Chemours): This is the industry-standard brand of ion exchange membranes and dispersions used for electrochemical applications.

- DuPont: The historical creator of Nafion, though they no longer produce it following the spin-off of Chemours.

- Ion Power: A premier distributor of Nafion™ products that also specializes in RECAST Nafion thin films and membrane coating services.

- W. L. Gore & Associates: Produces GORE-SELECT® membranes, which use a reinforced structure to provide thinner and more durable alternatives to standard Nafion.

- Asahi Kasei: Manufactures Aciplex™, a high-performance PFSA membrane that competes directly with Nafion.

- Fumatech BWT: Offers the fumapem® series, providing a diverse range of cation and anion exchange membranes.

- Agfa-Gevaert: Produces Zirfon™ separators, which are high-efficiency alternatives used in alkaline systems rather than PEM.

- Ballard Power Systems: Integrates Nafion-type membranes into its proprietary fuel cell stacks.

- FuelCell Energy: Utilizes PEM technology and Nafion-based materials for hydrogen electrolysis and energy storage projects.

- Gem Fuel Cells: Manufactures PEM fuel cell stacks and educational kits that incorporate Nafion membranes.

- Dow Chemical: Focuses on ion exchange resins (Amberlyst™) rather than direct Nafion-equivalent PFSA sheets.

- Membrane Solutions: Provides laboratory-scale filtration products and may distribute Nafion-based materials for specialized separation.

- GreenTech Energy Solutions: Operates as a consultant or integrator, implementing Nafion-based systems into energy projects.

- Xincotec: Offers specialized manufacturing and testing equipment used to characterize Nafion and other thin-film membranes.

-

Triton Consulting: Provides technical advisory services for the selection of materials like Nafion for energy projects.

More Insights in Towards Chemical and Materials:

Nafion Market Top Key Companies:

- Dow Chemical

- Triton Consulting

- FuelCell Energy

- AgfaGevaert

- GreenTech Energy Solutions

- Xincotec

- Gem Fuel Cells

- Asahi Kasei

- Ballard Power Systems

- Nafion

- DuPont

- L. Gore and Associates

- Fumatech BWT

- Ion Power

- Membrane Solutions

Recent Developments

- In May 2025, The Chemours Company established a partnership with DataVolt. Also, the main motive behind this collaboration is to create advanced cooling solutions for data centres as per the published report.

- In September 2025, Professor Xiangfeng Duan and graduate student Boxuan Zhou (Materials Science and Engineering) lead a research team that has developed a durable, low-cost, printable light-emitting membrane from ultrathin molybdenum disulfide and Nafion, with strong potential for chip-integrated photonic devices

-

In November 2025, Columbia Engineering chemical engineer Dan Esposito and his team are developing an alternative to Nafion. Their work, supported by the U.S. Department of Energy and in collaboration with industrial partners Nel Hydrogen and Forge Nano, aims to replace the Nafion membranes used in conventional electrolyzers with ultra-thin, PFAS-free oxide membranes. Replacing this component eliminates upwards of 99% of the PFAS contained in an electrolyzer.

Nafion Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2019 to 2035. For this study, Towards Chemical and Materials has segmented the global Nafion Market

By Application

- Fuel Cells

- Chlor-Alkali Process

- Electrolyzers

- PVD Processes

By Product Type

- Membrane

- Dispersion

- Resin

By End Use

- Energy

- Automotive

- Chemical Processing

- Electronics

By Form Factor

- Sheet

- Film

- Coating

- Powder

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Immediate Delivery Available | Buy This Premium Research Report@ https://www.towardschemandmaterials.com/checkout/5633

About Us

Towards Chemical and Materials is a leading global consulting firm specializing in providing comprehensive and strategic research solutions across the chemical and materials industries. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations.

Our Trusted Data Partners

Towards chem and Material | Precedence Research | Statifacts | Towards Packaging | Towards Healthcare | Towards Food and Beverages | Towards Automotive | | Nova One Advisor | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics | TCM Blog

For Latest Update Follow Us: https://www.linkedin.com/company/towards-chem-and-materials/

USA: +1 804 441 9344

APAC: +61 485 981 310 or +91 87933 22019

Europe: +44 7383 092 044

Email: sales@towardschemandmaterials.com

Web: https://www.towardschemandmaterials.com/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.